How Home Owners Warranty Insurance can Save You Time, Stress, and Money.

The Buzz on Home Owners Warranty Insurance

Table of ContentsThe Main Principles Of Home Owners Warranty Insurance Little Known Facts About Home Owners Warranty Insurance.The Best Guide To Home Owners Warranty InsuranceThe Of Home Owners Warranty InsuranceSome Known Questions About Home Owners Warranty Insurance.Examine This Report on Home Owners Warranty Insurance

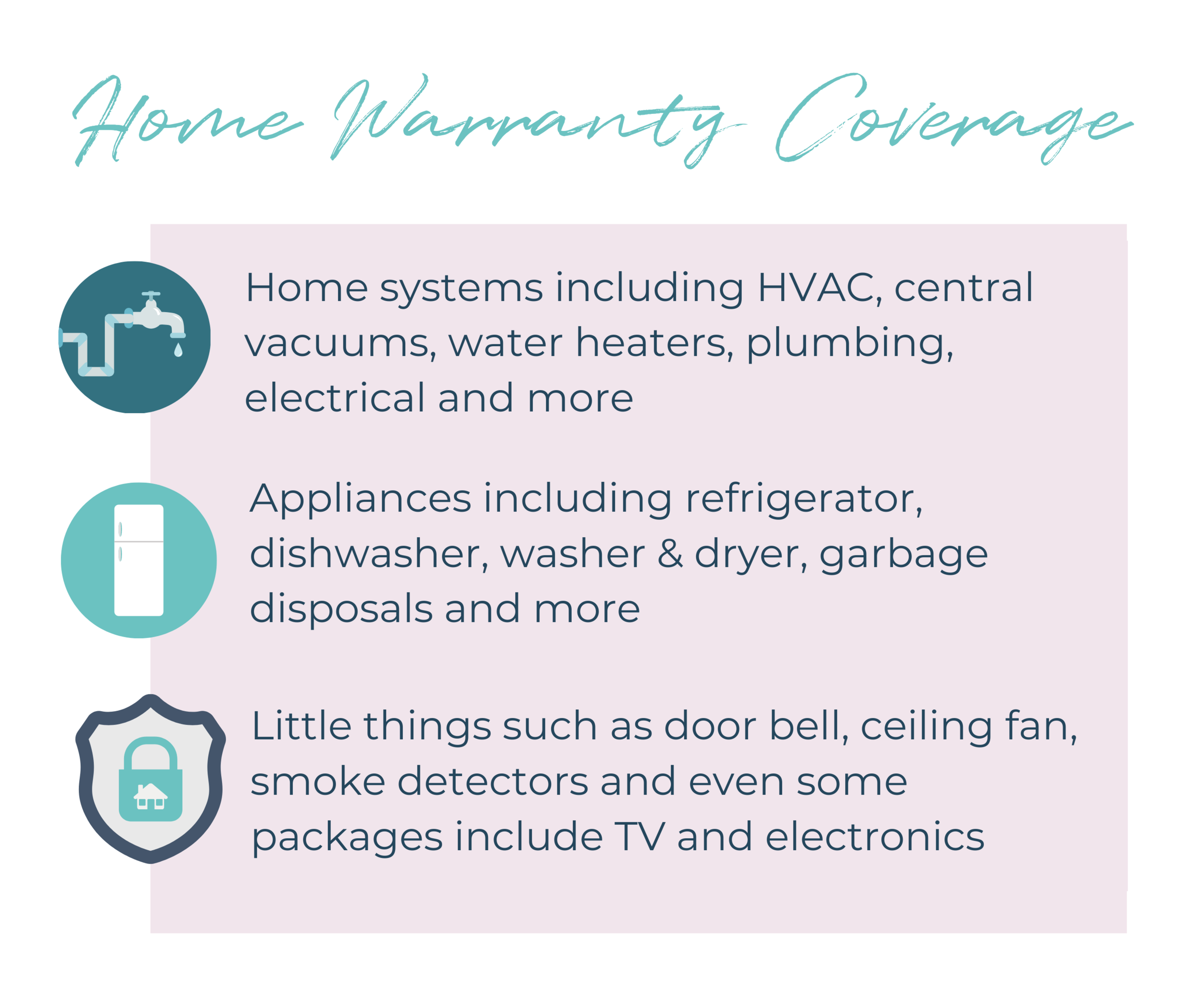

For many individuals, a residence is just one of one of the most pricey purchases they will ever make. It is essential to understand the various sorts of coverage (builder warranty versus home service warranty or solution agreement), what they cover, exactly how to make an insurance claim, as well as how to take care of problems that may appear in between you and also the builder or the guarantee firm (home owners warranty insurance).It covers items that are commonly a long-term component of the residence, like concrete floors, pipes, or electrical job. The majority of freshly constructed residences feature a home builder warranty. A is actually a, and prices added. It commonly relates to existing houses and covers replacements and also fixings on things like appliances or cooling systems.

Coverage Lots of residence warranties are backed by the builder. Builders might likewise acquire warranties from third-party independent firms. The Federal Housing Authority (FHA) and the Division of Veterans' Matters (VA) require builders to buy third-party warranties as a means to protect customers of recently constructed residences with FHA or VA fundings.

The Definitive Guide to Home Owners Warranty Insurance

Service warranties also generally lead to out just how repairs are made. The length of insurance coverage differs depending on the part of your house. Protection for handiwork and materials on a lot of components normally runs out after the first year. Many guarantees on new building and construction cover home siding and stucco, doors and also trim, and also drywall and paint throughout the initial year.

Some contractors give insurance coverage for approximately ten years for "major structural issues," sometimes defined as issues that make a house dangerous as well as placed the owner at risk. For example, a roof covering that might collapse is a "significant architectural problem." Scenarios and Products Normally Not Covered The majority of new residence guarantees out-of-pocket expenditures arising from a significant building problem or guarantee repair, like the expense of vacating your house as well as living elsewhere while fixings are made.

It's always good to have a document of your dealings with the contractor as well as the guarantee company. Dealing with Troubles Disputes often take place between a house owner as well as a contractor, or third-party guarantee company, over whether an issue is covered or whether repair service work was done properly.

An Unbiased View of Home Owners Warranty Insurance

For additional information To find out more regarding new house warranties, contact your state or local building contractors' board. If you have a funding insured by FHA, get in touch with the closest field office for the united state Department of Housing and check my source Urban Growth or see . If you have a VA lending, contact the nearby VA office, or see www.

Some Ideas on Home Owners Warranty Insurance You Should Know

/best-home-warranty-companies-4158878_V3-2d7d24f6760f436289b01ea382feca97.png)

"Yet are you financially prepared to change significant parts as they are required, or would certainly you instead pay a set amount annually whether something breaks or not?" The ideal idea is to get several quotes from companies to contrast prices and protection. Then determine which, if any type of, the most effective home service warranty firm for you is.

Home warranties vary from provider to service provider in terms that site of what they cover. In some cases, customers might likewise be able to include on even more coverage for particular home appliances.

The Buzz on Home Owners Warranty Insurance

You can do so by phone, and numerous providers likewise have web sites or mobile applications you can use to contact us about an insurance claim. You should contact your house service warranty company whenever a device breaks or quits functioning. After you make a claim with your home warranty provider, they'll contact an expert provider.

Before you get a residence warranty, you ought to make sure to read the example agreement. Every home warranty firm worth doing service with will have an example agreement available on its website. No person appreciates reviewing the small print, but it's definitely important for home owners to take a close consider these agreements before acquiring house warranties.

You ought to be certain to check the recall period, the responsibility caps and the agreement term. We have actually made that process easier for you right here, by contrasting strategies, advantages as well as restrictions of the 8 ideal home service warranty firms.

Little Known Questions About Home Owners Warranty Insurance.

Your home guarantee choice is around more than simply discovering the best service provider; you'll also require to pick the appropriate insurance coverage prepare for your house. You don't intend to pay for even more protection than you require, however at the very same time, you don't desire to pay of pocket when something you neglected breaks down.

After that determine the complete expense as well as compare. Residence service warranties may not be needed depending upon the age as well as expense of your appliances and home systems - home owners warranty insurance. They can additionally supply tranquility of mind to house owners as well as a simple repair if any type of appliance breaks and requires to be taken care of or replaced.